It's an age old imbalance. Is the "market" in favour of the buyer or in favour of the seller? To find the answer we need to stop and think what determines the market.

What?

A market is a place where goods are offered and are purchased by "ready, willing and able" buyers. In this case your zoopdiloops and Leftmove, otherwise known as the property market. Properties are offered to x number of buyers that are looking and if the right buyer presents itself, and they see value in the proposition, they purchase at the (asking) price. Should the buyer not see value they will not buy. If the value is perceived to be good a seller can expect a number of bids.

Buyers and sellers

Is that all it boils down to? Well yes, but maybe if you zoom in it's more nuanced than that. For instance if a property requires renovation you will often need to subtract the cost of the works and then some to allow for someone to put in the time and effort to actually renovate it (time isn't free, you know!) and in the case of a developer some more margin for finance costs and stamp duty and so on (again, they do this for a living, certainly not for free).

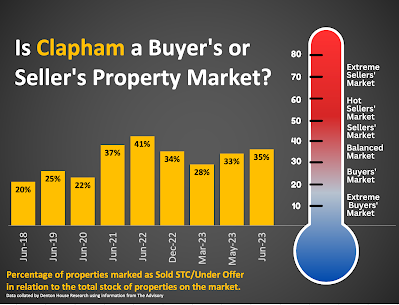

So if there are MORE properties coming to the market this increases supply. Prices will therefore "soften" or come down if there are the same number of buyers looking for a property in this market. You can see by my clever graph that Clapham has been fairly balanced for a while now, with just under half (35%ish) properties marked under offer. Should the market be busier the number of properties available dries up and you have the same number of buyers chasing fewer properties.

But what about times ahead? Mortgage rates are high - will they go higher? Remember the average property price in Clapham is considerably higher than the rest of the UK, so an increase in interest rates will certainly have an impact on affordability. I have found in my experience that buyers borrow the maximum they can and if they are searching for property soon or even now they might have a little bit less to spend on the purchase because they simply can't afford the higher repayments!

Property prices will plummet?

If we indeed see rates rise and affordability reduce then a correction will be in order. The property prices will see a small drop. I wouldn't say any property in London will plummet per se. In fact I foresee that demand will stay rather strong. It's more than likely that the trend of the past decade - the Bank of Mum and Dad - will simply step in and offer larger deposits for their offspring to keep mortgage payments in check. After all they are sitting on a lot of equity that is not being utilised per se. What will really happen? Time will tell; but for now I will continue to be selling property in South London, duty calls!

If you are looking to sell or let your property in South London then by all means get in touch for a valuation by email or check out my nifty online appraisal tool if you just wanted a rough idea on value!

No comments:

Post a Comment