In a shocking news: a survey from The Mortgage Lender has revealed that nearly a quarter (24%!!!) of First Time Buyers did not know that they would have to pay stamp duty when buying a home!

I mean can you Adam and Eve it? You are about to undergo arguably the biggest, most important purchase of your life and you haven't researched it to the nines? Other things that buyers revealed they didn’t factor into their budget when buying their first home include solicitor’s fees, valuation fees, surveyor’s fees, and the cost of a homebuyer survey.

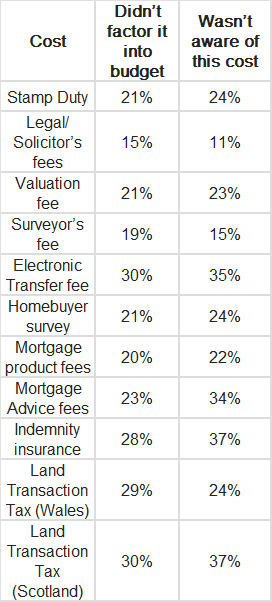

Have a look at the table below and see how uneducated the average first time buyer is today...

You would think in this day and age of technology and information these sorts of things could be practically absorbed via osmosis, but sadly it's clearly too much information for the average first time buyer to handle. Thankfully I have not had to speak to any first time buyers in the last years who were unaware of these. Service charges are at the top of buyers' agendas these days, with leasehold charges spiralling onwards and upwards having a reasonable service charge for a reasonable level of service is of key concern to many buyers as affordability levels are currently stretched.

So what are the agents doing to educate? Thankfully there are good agents out there that insist that buyers look at mortgages and assess affordability before viewing in order to prevent wasted efforts, time and above all heartbreak when they find their dream property is out of reach. In my experience this journey (the affordability journey) ensures there's enough money to pay for the one-off fees as well as ongoing fees and maintenance.

Crisis averted! You would think....

No comments:

Post a Comment